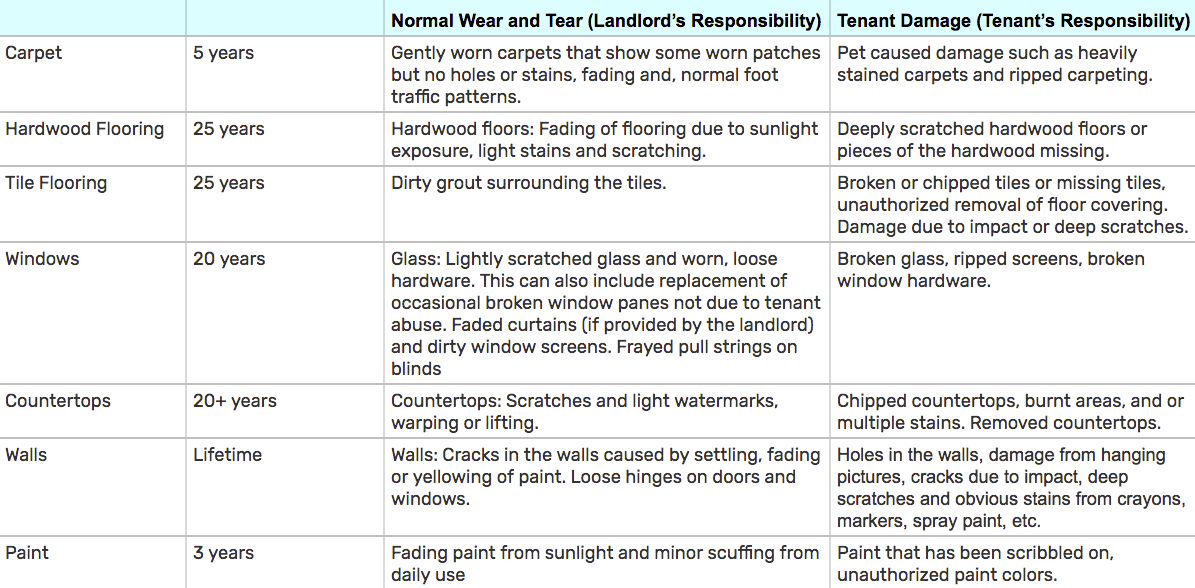

If the item is well past it s life expectancy it would not be fair to award the landlord the full replacement cost because to do so would put the landlord in a better position than s he was in prior to the item being damaged by the tenant.

Life of carpet for depreciation in texas.

Carpets have a life expectancy of about 10 years.

So charging them 220 would have been unfair.

Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above.

But what is class life.

Carpet life years remaining.

I thought carpet had a 7 year depreciation.

Whether it is carpet a stove mini blinds or a hardwood floor all items have an estimated life expectancy.

Expected life of carpet.

Thus if the class life of carpet e g is more than 4 but less than 10 years the landlord depreciates carpet over 5 years because it is 5 year property.

Pay a portion of the total.

So at a cost of 700 then 500 of that was depreciated which left the carpet s value at 200.

The landlord should properly charge only 200 for the two years worth of life use that would have remained if the tenant had not damaged the carpet.

Original cost of carpet.

If you re a tenant ask to see proof of how old the carpet is and when the landlord expects to replace it.

I definitions and special rules for purposes of this section 1 class life.

10 years depreciation charge 1 000 10.

Know a carpet s life expectancy.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

100 per year age of carpet.